Background

The basic purpose of life insurance is to bridge any potential gap between your survivors’ financial needs

and their available resources. This fact sheet covers basic information about life insurance and provides

specific information about life insurance options available only to active duty USPHS Officers, their spouses,

and dependents.

Life insurance policies purchased through a group (usually employment-based) have two advantages over

policies purchased by an individual: they are less expensive and require no medical exam. There are two

basic types of life insurance:

Term Insurance pays only if death occurs during policy term (usually 1—30 years). Benefit amounts

remain constant but the premiums may increase with age. It is usually purchased by comparison

shopping on cost and is lower initially than Whole Life (see below). About half of all life insurance

policies, including those available through the Commissioned Corps, are Term Insurance.

Whole Life (or Permanent) Insurance combines death benefits covering an entire lifetime with a

cash value accumulation feature. Premiums are fixed with early premiums being higher than actual

protection costs in order to build cash value redeemable before death. Whole Life policies, which

are more complex than Term, are not available through the Commissioned Corps.

Eligibility

Active duty PHS Officers, their spouses, and dependents are eligible for Commissioned Corps Term Life

Insurance.

Active duty officers and their civilian spouses are automatically covered ($400,000 SGLI for officers,

$100,000 FSGLI for spouses). A specific request must be made to decline or reduce coverage.

Request forms are available at www.benefits.va.gov/INSURANCE/resources-forms.asp. Use SGLV

Form 8286 for officers and SGLV Form 8286A for spouses who are not members of the Uniformed

Services.

Dependent coverage of $10,000 is free and automatic and cannot be declined or reduced.

To manage the amount of SGLI and spouse coverage and designate and update beneficiaries,

officers should use the SGLV Form 8286 or 8286A. The Commissioned Corps is planning to migrate

to the SGLI Online Enrollment System (SOES), which will enable online enrollment for SGLI and

FSGLI. As of April 2018, the timeline for this migration was unknown.

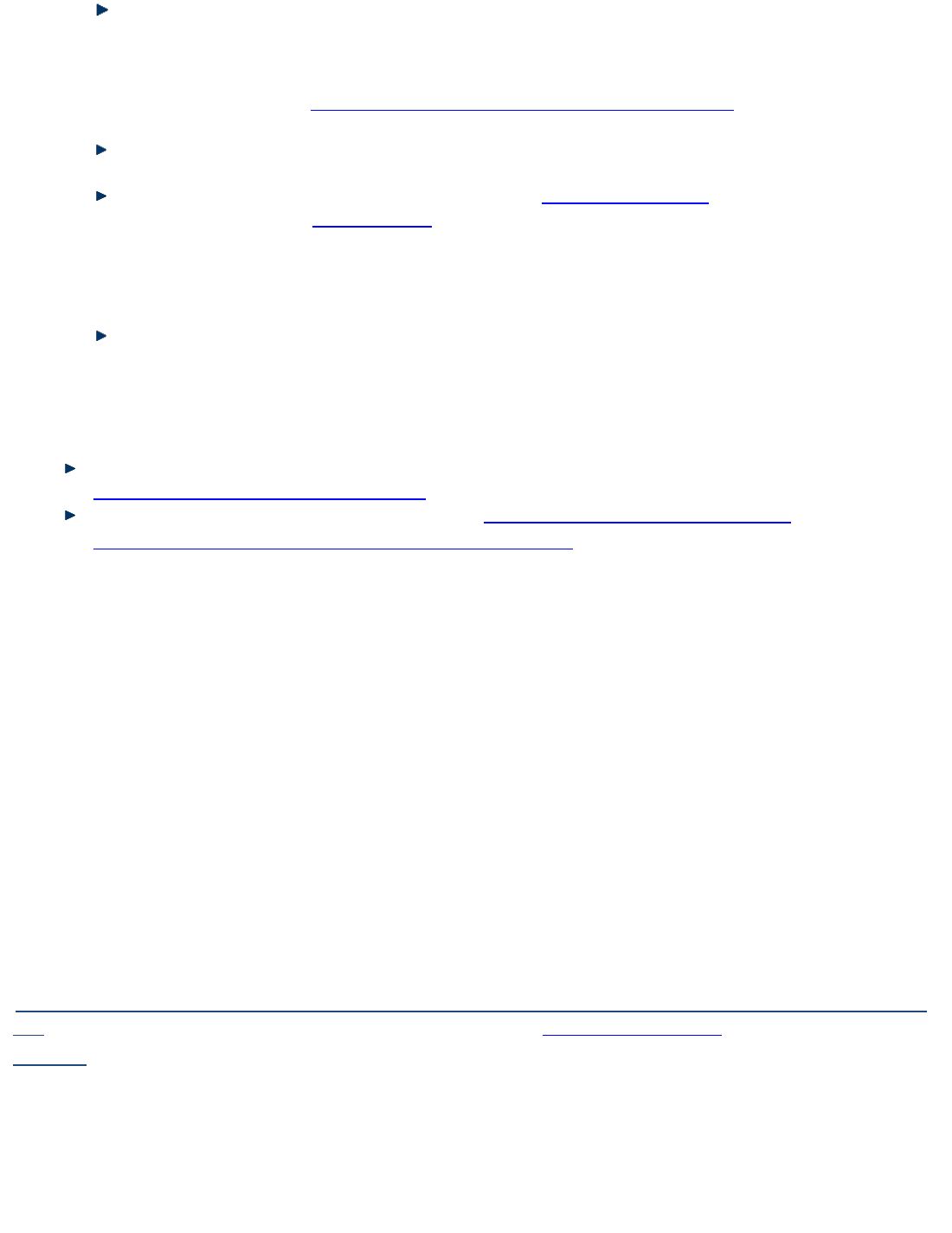

Insurance Options

Eligibility

Limits

Cost

Further Info

SGLI (Servicemembers'

Group Life Insurance)

Active Duty (AD)

USPHS

Up to $400K in $50K

increments

$3.50/$50K/month

(plus $1/month trauma

protection)

www.insurance.va.gov

see SGLI

FSGLI (Family

Servicemembers' Group

Life Insurance)

Spouses and

children of AD

with SGLI

Spouse: up to $100K or AD

officer coverage, whichever

is less

Dependent: $10,000

Spouse: $2.50—

25/$50K/month

(depending on age)

Dependent: Free

www.insurance.va.gov

see FSGLI

FACT SHEET

Life Insurance for Active Duty Public Health Service Officers

Last Reviewed: June 19, 2018

Highlights

Officers should consider estimating life insurance needs for themselves and their family:

Use the basic formula: Life insurance amount = financial obligations (plus) net income to support

survivors (minus) other assets. Consider all of your survivors’ financial needs, including debts (e.g.,

medical, funeral, and estate taxes), life income needed for spouse, mortgage and car payments,

and children’s education and expenses until independent.

- Online calculator at http://www.benefits.va.gov/INSURANCE/introCalc.asp

- Rough estimate is 10 times your gross salary

While SGLI is a good value for many PHS Officers, it may not be enough to meet your specific life

insurance needs.

Certain companies (e.g., Navy Mutual Aid Association www.navymutual.org or United Services

Automobile Association www.usaa.com) cater specifically to insurance needs of those on active

duty. Consult other sources of information — such as a financial advisor or insurance agent — for

additional details about your insurance needs. Using your existing connections, like your financial

advisor or investment firm, may help simplify or lower costs. Many reputable companies exist, but

do your homework before purchasing additional coverage.

Remember that:

− Even with life insurance coverage, you should have a legally valid and available will

− Any lapse in paying your premium could result in cancellation of your policy

Resources

Life Insurance Buyer’s Guide from the National Association of Insurance Commissioners —

http://www.naic.org/index_consumer.htm

Consumer Report information on life insurance — https://www.consumerreports.org/life-

insurance/how-to-choose-the-right-amount-of-life-insurance/

Note: Feedback and suggestions for this fact sheet are welcome and may be sent to PPACBenef[email protected]m.

Disclaimers: This fact sheet is provided for informational purposes only and is not an official policy document. The presence of external hyperlinks

(or the information, products or services contained therein) in this fact sheet does not constitute endorsement by the USPHS or the Physician

Professional Advisory Committee (PPAC). In addition, the information provided here is based on publicly available information as of the date this

fact sheet was last reviewed and might not reflect the most recent or emerging changes on the topic covered. When researching a topic, the

reader should also be aware that some publicly available USPHS documents on benefits are outdated and contain information that will require

verification.