THE ECONOMIC

IMPACT OF VIDEO

ON

-DEMAND

SERVICES IN

AUSTRALIA

2022

WWW.FRONTIER-ECONOMICS.COM

BERLIN | BRUSSELS | COLOGNE | DUBLIN | LONDON | MADRID | PARIS

THE ECONOMIC

IMPACT OF VIDEO

ON-DEMAND

SERVICES IN

AUSTRALIA

WWW.FRONTIER-ECONOMICS.COM | 2

EXECUTIVE SUMMARY

services make significant

investments in Australian content

and the AV industry, creating jobs

and promoting local content. VOD

services are in high demand from

consumers. This drives investment

by VOD services in high-quality

productions made in Australia that

they can then showcase to global

audiences.

These investments bring benefits to

the economy and society more

broadly. Investments in training or

infrastructure spill over to the AV

sector as a whole, spur tourism,

enhance Australia’s reputation and

support wider social goals.

Investment in Australian content is

already high. If policies are

considered, total impacts need to be

assessed and they should focus on

maintaining incentives and ensuring

Australia remains an attractive place

to produce. Some policies can boost

investment, but others can act as

deterrents. We have found that tough

policy restrictions reduce

broadcasting exports and are

associated with lower investment in

content.

This White Paper summarises

research Frontier Economics has

undertaken into the economic impact

of protectionist policies in video

content production. It also highlights

the economic impact that VOD

services have in Australia, and the

implications for policymakers who

wish to encourage and benefit from

such investments.

THE ECONOMIC IMPACT OF

VIDEO ON-DEMAND

SERVICES IN AUSTRALIA

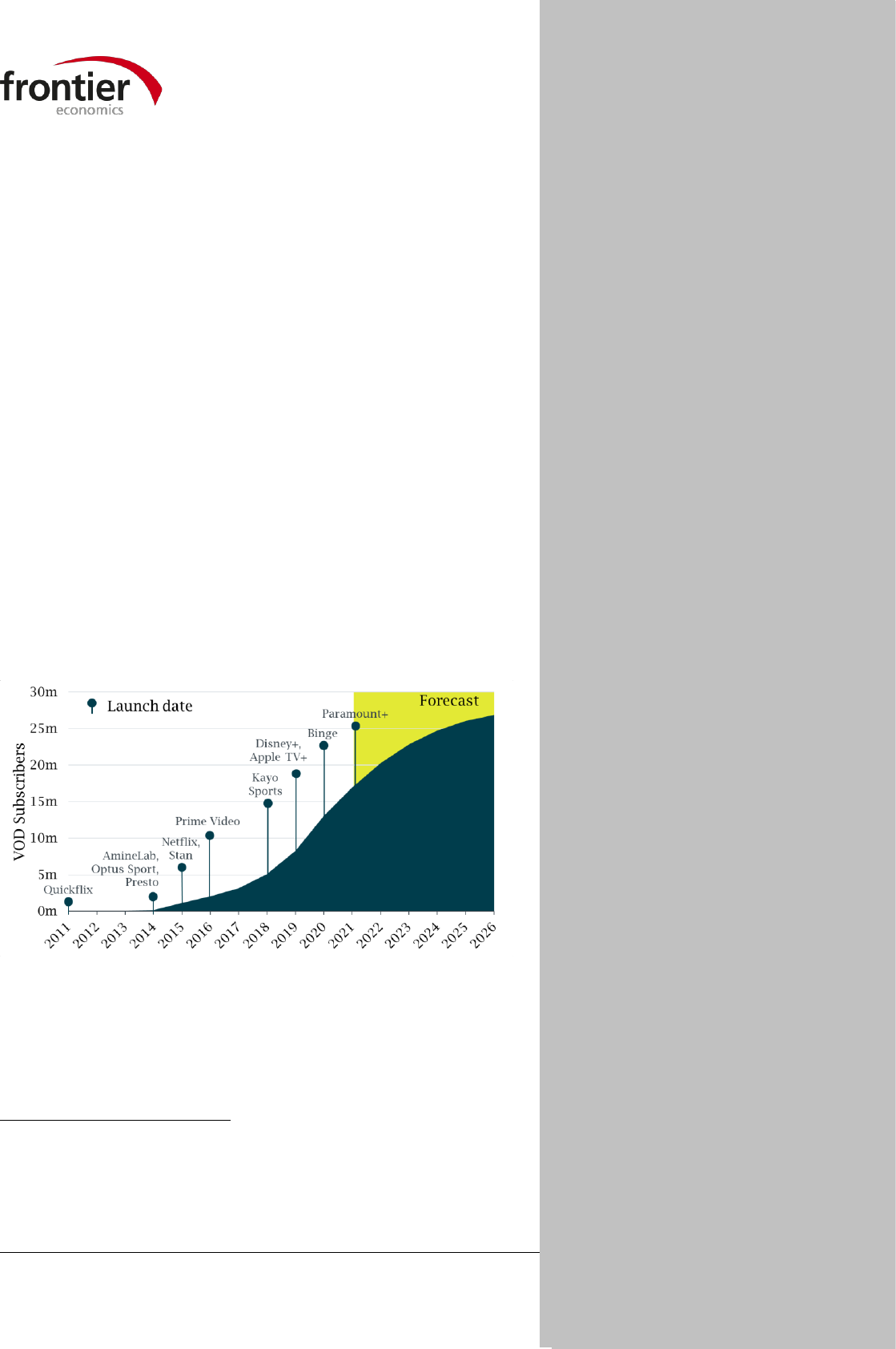

1. VOD services are starting to take off in Australia

Australia supports a vibrant video on-demand (VOD)

*

sector with

consumers recently spoilt for choice of services. The popularity of

the services, and the local content they offer, has been growing

and there were nearly 13m Australians holding a VOD

subscription in 2020 (Figure 1).

1

Though the sector is relatively

young, with VOD services launching later in Australia compared

with other countries, already 72% of internet users in Australia

use VOD at least once a week,

2

spending 40% of their time on VOD

services watching local content.

3

VOD related revenue is increasing. Revenue generated by

Australia’s broadcasting and online video sector grew by 9%

between 2010 and 2020, following the entry of VOD services,

*

The term video on-demand (VOD) refers to professional and curated online video

content and does not include user-generated platforms such as YouTube.

Alternative terms can be used to describe video on-demand services, including

direct-to-consumer services (DTC), online curated content (OCC) and online

subscription services.

FIGURE 1 GROWTH OF VOD SUBSCRIBERS OVER TIME

Source: Ampere

Note: VOD subscribers include any VOD subscription customers that pay a fee. Launch date is

the year the service could be first used in Australia. Figures from 2021 are forecast

EXECUTIVE SUMMARY

Video on-demand (VOD) services

were launched later in Australia

compared with other countries but

already make important direct and

indirect economic contributions to

the country’s audiovisual (AV)

industry. VOD services make

significant investments in Australian

content and the AV industry,

creating jobs and promoting local

content. VOD services are in high

demand from consumers. This drives

investment by VOD services in high-

quality productions made in

Australia that they can then

showcase to global audiences.

These investments bring benefits to

the economy and society more

broadly. Investments in training or

infrastructure spill over to the AV

sector as a whole, spur tourism,

enhance Australia’s reputation and

support wider social goals.

Investment in Australian content is

already high. If policies are

considered, total impacts need to be

assessed and they should focus on

maintaining incentives and ensuring

Australia remains an attractive place

to produce. Some policies can boost

investment, but others can act as

deterrents. We have found that tough

policy restrictions reduce

broadcasting exports and are

associated with lower investment in

content.

This White Paper summarises

research Frontier Economics has

undertaken into the economic impact

of protectionist policies in video

content production. It also highlights

the economic impact that VOD

services have in Australia, and the

implications for policymakers who

wish to encourage and benefit from

such investments.

WWW.FRONTIER-ECONOMICS.COM | 3

which now include Netflix, Stan, Binge, Disney+ and more. Since 2011, the revenue of VOD services has

risen to $940m (AUD1.4bn

4

)

5

, and it is projected to rise to $2.5bn (AUD3.6bn) by 2025.

6

GLOBAL INVESTMENT, LOCAL IMPACT

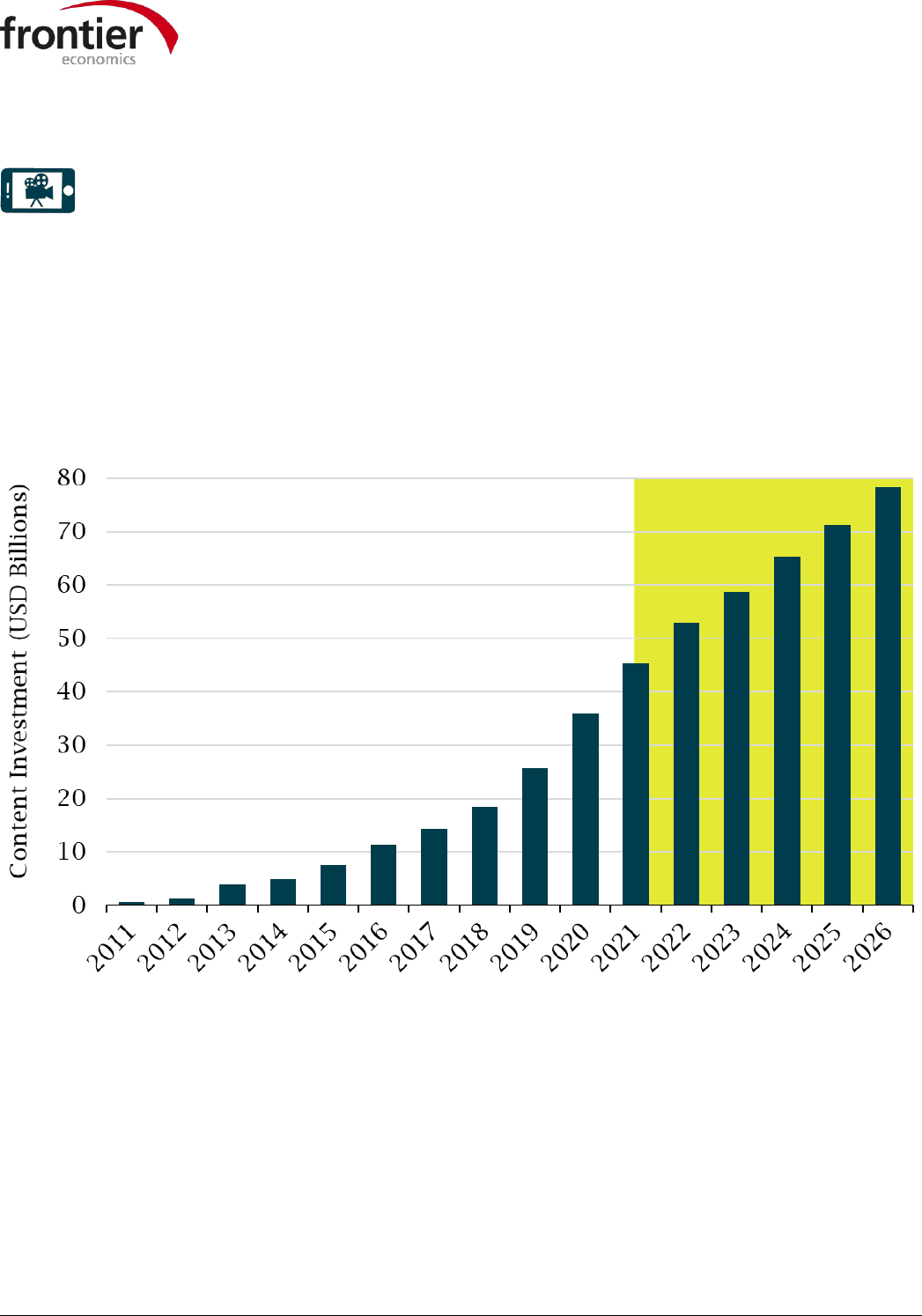

2. VOD services are generating a creative content boom

VOD services invest heavily in content to support their services globally. In 2020, they directly invested

$36bn (AUD52.3bn) in VOD content worldwide, covering original and licensed titles. This sum is likely to

increase to $78bn (AUD113bn) by 2026.

FIGURE 2 GLOBAL VOD CONTENT INVESTMENT 2011 TO 2026

Source: Ampere

Note: VOD content investment includes content spend by both subscription VOD and ad-based VOD companies

The significant increase in content investment in the pipeline includes:

The Walt Disney Company’s plans to invest $14bn-16bn (AUD20.3bn-23.3bn) per year in global

VOD content by 2024;

ViacomCBS’s plans to ramp up investment in VOD content to $5bn (AUD7.3bn) in 2024;

7

A pledge by WarnerMedia’s parent company, AT&T, to invest $4bn (AUD5.8bn) in HBO Max,

including HBO Max original programmes which are available on various platforms in Australia

including Binge, in the three years through 2022;

8

and,

Netflix will spend $28bn (AUD41bn) a year by 2028.

9

Forecast

WWW.FRONTIER-ECONOMICS.COM | 4

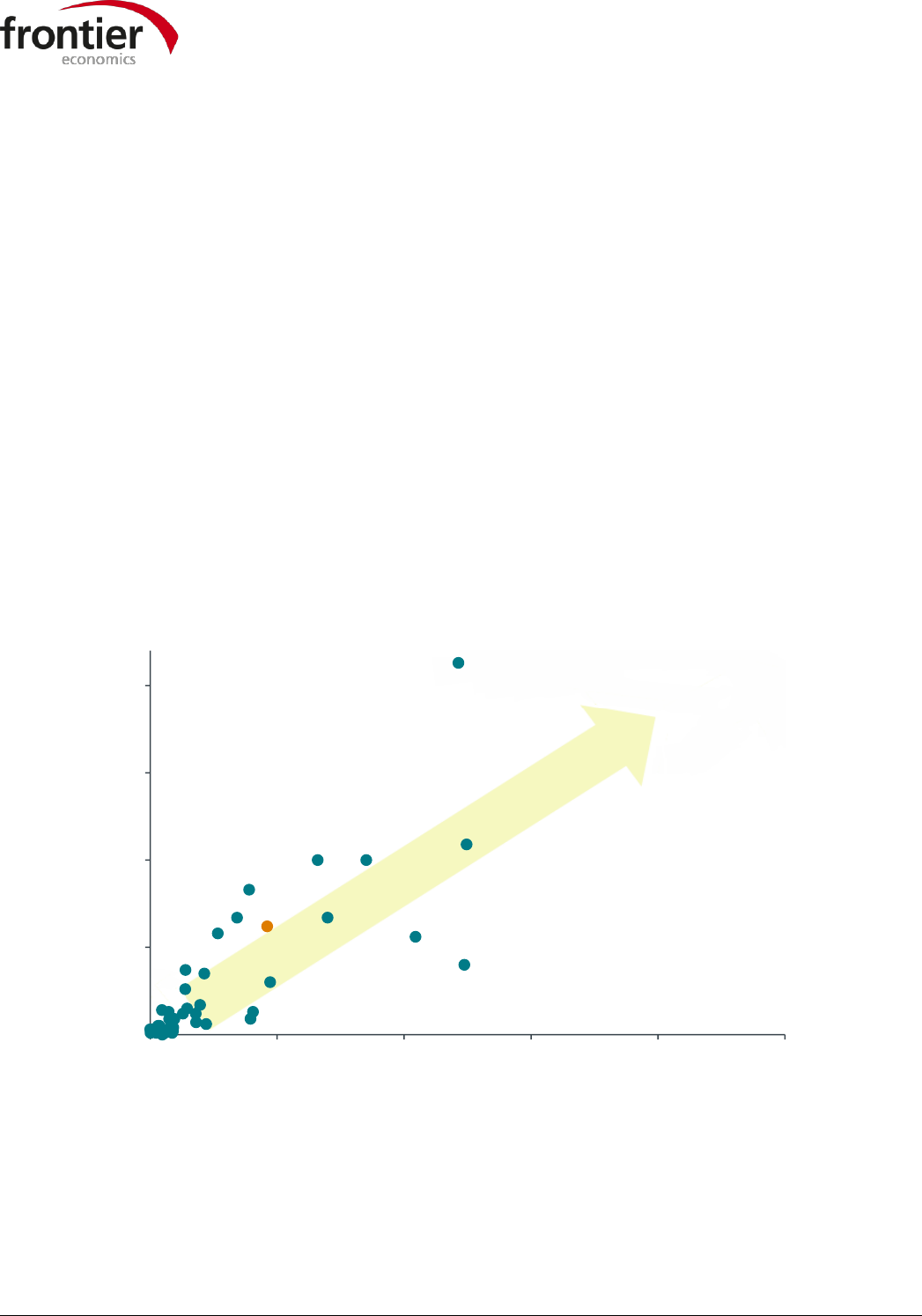

3. VOD services are investing in Australian content

Frontier Economics’ research has found that there is strong consumer demand for Australian content and

that this drives investments in Australian content by VOD services and independent producers. As a

country’s VOD service subscriber base grows, so do the incentives to produce local content.

Hence, the overall geographic distribution of VOD investment in original titles is broadly proportionate to

each country’s number of VOD subscribers (Figure 3). This relationship holds in Australia. Subscribers are

not the only determinant of investment in local content as success of previous content exports from the

country (US, UK, South Korea, Canada), commonality of the spoken language (such as Spanish or English),

or comparatively lower local production costs (Mexico, Indonesia) can also determine investment.

It is important to note that leading content providers invest in Australian content and the Australian

industry not only for their VOD services but for all their distribution channels, including linear and

theatrical distribution. In 2019, The Walt Disney Company, NBCU, WarnerMedia and ViacomCBS collectively

poured $45bn (AUD65bn) into content spending and creation globally (excluding sports) across their

distribution channels, which they will partly monetise on their VOD services (Disney+, Peacock, HBO Max

and Paramount+ respectively).

FIGURE 3 RELATIONSHIP BETWEEN VOD SUBSCRIBERS AND MARKET-SPECIFIC VOD “ORIGINAL” TITLES

Source: Frontier analysis of Ampere and Media Partners Asia data

Note: VOD subscribers include any global subscription VOD customers in 2019 who paid a fee. The 2019 values of VOD subscribers are used as they are the

most comparable to the VOD originals data which covers investment pre-pandemic. Pre-pandemic data has been used because of the uneven impact of the

pandemic on AV industries across the world. A title has been included as a VOD original title if it was produced by the VOD service and released only on the

VOD service. The sample of titles reflects the catalogues of VOD services available in the following markets: Argentina, Australia, Brazil, Canada, Colombia,

India, Indonesia, Mexico, Korea and Taiwan. VOD services included in the sample of titles are: Netflix (18% of titles), Amazon Prime Video (18%), Hotstar

(7%), Wavve (7%), Foxtel Now (6%), iflix (5%), Eros Now (5%), WatchaPlay (4%), HamiVideo (4%), Hooq (4%), Claro Video (3%), friDay (3%), myVideo (3%),

myVideo (2%), Looke (2%), SonyLiv (2%), VIU (1%). Others (inc. Globo Play, CraveTV, Vidio, Stan, Disney+, Apple TV+ and Crunchyroll – 10%). The data

includes content titles that were available between June 2017 and April 2020, and an additional set of titles that were available in October 2020 in

Indonesia, so does not reflect the most recent releases. All markets that have had a VOD original title produced in their market are included in the analysis.

China has been excluded as data was not available. Note that US and India are not included in the figure since they are outside the limits of the scale. See

technical annex for further detail.

Argentina

Australia

Brazil

Canada

Colombia

France

Germany

Indonesia

Italy

Japan

Mexico

South

Korea

Spain

Taiwan

UK

0

50

100

150

200

0m 10m 20m 30m 40m 50m

Number of VOD Original Titles

Number of VOD Subscribers

WWW.FRONTIER-ECONOMICS.COM | 5

The relationship set out in Figure 3 is likely to continue to hold in Australia in coming years. In addition,

since 2019, following the further entry of new VOD services in Australia, there has been a steady increase

in subscribers, and corresponding new investment in local content with VOD services making significant

investments in content in Australia, both individually and in partnership with traditional broadcasters.

Amazon Prime Video, Disney+, Netflix and Stan spent AUD629m on Australian and Australian-

related programs in the 2020-21 financial year

10

(of which AUD179m was spent on Australian

content

11

and AUD450m was invested in “Australian-related content”

12

). Much of this investment

focused on commissioning new or acquiring Australian drama, documentaries and children’s

programmes. The spend by the four VOD services increased compared to the 2019-20 financial

year as investment in Australian programs increased by 17% from AUD153m and investment in

“Australian-related content” nearly quadrupled from AUD115m.

13

ViacomCBS, announced that it has invested in exclusive Australian productions for its recently

launched Paramount+ including The Last King of the Cross, Spreadsheet and 6 Festivals.

ViacomCBS’s head of Australian content Bev McGarvey said at launch that “We want to be able to

use Paramount+ to tell strong Australian stories.

14

Following the launch in October 2021, at the

ViacomCBS Australian Upfronts, further local content investments were announced, including a

new season of popular Australian drama Five Bedrooms, along with documentary series Couples

Therapy, and a major new reality adventure series The Bridge that will be filmed entirely in

Tasmania.

15

At the event ViacomCBS’s Bev McGarvey said “Our selection really captures the essence

of what makes entertainment in Australia so powerful. There’s depth in the narratives and

complexity to the characters; the production values are world class; and our cast and local crews

only underline the diverse, talented bunch we are.”

Since launch in 2015 Stan has commissioned local productions with budgets totaling around

AUD300m,

16

and the Australian owned and operated streaming service is continuing to increase

its investment in local television and film. The strategy will see Stan ramp up its output to deliver

around 30% of its first-run slate from original productions.

Since 2019, Amazon Prime Video has commissioned 14 Amazon Original series in Australia,

investing AUD150m in local productions and creating more than 2,500 jobs. Amazon is investing

in a diverse range of Austrlian content, which includes comedies, documentaries, reality and

scripted dramas. Tyler Bern, Head of Content, Prime Video Australia, said that “We know that

viewers in Australia want to see new, fresh, unique and authentic stories that they can connect with,

and we’re committed to producing diverse Australian programming for Prime members globally”.

17

Netflix invested AUD110m in the four years to 2020 in Australian original and co-produced

children’s programs alone.

18

And in 2020, Netflix invested in 16 new Australian titles such as its

AUD36m investment in the recent original series Clickbait.

19

Disney in the fiscal year ending June 2021, in addition to filming two Marvel movies back to back

in Sydney, funded the Australian crime comedy Mr Inbetween, brought 9 Perfect Strangers with

Nicole Kidman to Byron Bay and shot Limitless and Shark Beach with Chris Hemsworth in

Australia. In addition, Disney+ Australia is now making Shipwreck Hunters Australia a six-part

documentary series filming now off the coast of Western Australia.

WWW.FRONTIER-ECONOMICS.COM | 6

Screen Australia has found that investment by VOD services in drama content, some of which is

outlined above, has increasingly been in high-end content as the average cost-per-hour of the titles

has increased over the last five years.

20

High-end, high budget content can have larger economic

impacts through job creation, increased exports due to potentially being more popular globally

and through wider spending on inputs needed for production.

As illustrated, VOD services have committed to individual specific investments in Australian content.

However, on top of this, VOD services and the media companies supporting them also engage in complex

investment partnerships and co-productions.

4. VOD services are creating jobs and are delivering returns for the economy

The media companies offering VOD services create jobs directly in the production sector across activities

within the AV ecosystem. These include VOD services, feature films, TV content production, physical

production facilities, digital visual effects, and the distribution of pay TV channels. Additionally, research

finds that 60% of production costs are on average incurred in the general economy outside the AV sector,

for example on catering, hospitality, construction and legal services.

21

This spending broadens the

employment benefits and the media sector’s contribution to the Australian tax base.

The Australian media sector is a significant segment of the domestic economy, employing

approximately 90,000 Australians in 2018/19 and generating an estimated AUD47.7bn of

domestic revenue.

22

Investment in content, even content that is not considered Australian, can deliver returns for the

local economy. In the 2020-21 financial year investment in foreign filming productions in Australia

by Amazon Prime Video, Disney+, Netflix and Stan employed 56 Australian cast, 2,356 Australian

crew and over 5,000 Australian extras.

23

In 2020/21 a record AUD1.9bn was invested in Australia, across both Australian content and

foreign filming, on scripted drama content for film and TV. This is an 84% increase on 2019/20

and a 46% increase on the previous highest amount invested in 2016/17. In addition, a record

AUD874m of this was invested in Australian content.

24

The investment in content in 2020/21 was

spread throughout Australia as shown in Figure 4.

25

WWW.FRONTIER-ECONOMICS.COM | 7

FIGURE 4 SCRIPTED DRAMA CONTENT INVESTMENT IN 2020/21 BY STATE AND TERRITORY

Source: Screen Australia, Drama Report - Production of feature films, TV and online drama in Australia in 2020/21

Note: All values are in AUD. *The AUD18m in Northern Territory represents the scripted drama content investment across Northern Territory, Tasmania

and Australian Capital Territory as it is combined in the Screen Australia report.

Between 2017 and 2020, ViacomCBS’s investment in global film and television production in

Australia has delivered more than AUD130m to the local economy, supporting 990 jobs and

more than 700 Australian businesses.

26

This included popular 2019 childrens film Dora and the

Lost Cities of Gold, filmed on the Gold Coast. The cast included Eva Longoria who said of the local

film crew, “Brilliant, they were so great, they had big project after big project, so…it was one of the

most experienced crews I’ve ever seen just for the amount of work they’re continuously doing there.”

While Isabela Moner (who played Dora) said, “they (the production cast and crew) were wonderful,

Aussies are such good people. Specifically, I’ve never seen so many women crew members which is

so cool, really, really, cool and it felt like such a great environment to be surrounded by.”

27

Just one production can have a significant impact on the local economy.

In 2016, Disney spent a reported $180m (AUD262m) in Queensland shooting Thor: Ragnarok.

The production, now on Disney+, created more than 2,000 jobs for local cast, crew and production

office personnel.

28

In addition, the production of Thor: Love & Thunder (due for release in 2022),

filmed at Fox Studios Australia in New South Wales, is estimated to have brought $178m

(AUD259m) to the NSW economy, created 2,500 jobs and used services from 1,650 local

businesses.

29

WWW.FRONTIER-ECONOMICS.COM | 8

Apple TV+’s AUD55m investment in the original Shantaram series, which is still in production,

will provide up to 1,000 jobs in Victoria during production.

30

The series is based on a popular

Australian novel of the same name by Gregory David Roberts.

Netflix’s investment in Clickbait, which was written, co-created and produced in Victoria, brought

more than AUD36m of new international investment and engaged around 540 cast, crew and

extras and used the services of around 290 local businesses.

31

VOD productions can also bring economic activity outside city centres, to regional Australia. The

Hon Paul Fletcher MP, (Minister for Communications, Urban Infrastructure, Cities and the Arts) has

said Amazon Studio’s filming of season 2 of The Wilds was expected to bring investment of more

than AUD73m to the Australian economy and create more than 270 jobs for cast and crew.

32

At a

local level, filming at Deadman’s Beach, Frenchman’s Beach, South Gorge, Flinders Beach and on

Southern Moreton Bay is estimated by Redland City Council to have provided a direct economic

injection of more than AUD800,000 to the island and Redlands Coast economy. The production

saw 200 cast and crew staying on the island, resulting in about 4,000 hotel nights with local

accommodation providers.

33

The show, which was co-produced by Amazon Studios and ABC

Signature Studios, engaged Brisbane-based production company Hoodlum Entertainment as its

service company in Australia.

5. Australians are finding the local content they demand on VOD services

Frontier Economics surveyed 1,107 internet users in Australia and found they demand a diverse array of

content, both local and international, and that VOD services are delivering content consumers want and

love.

34

Consumers in Australia feel it is important that VOD services provide local content and Australian

consumers use VOD to watch local, Australian content. While the catalogues of VOD services offer

subscribers a wide mix of content from around the world, 40% of the content users stream is from

Australia.

40% OF HOURS WATCHED ON AUSTRALIAN VOD SERVICES WAS LOCAL,

AUSTRALIAN CONTENT

35

73% OF AUSTRALIANS CONSIDER IT IMPORTANT THAT THEIR VOD OR TV CONTENT

SERVICES PROVIDE AUSTRALIAN CONTENT

36

44% OF AUSTRALIAN VIEWERS THINK THAT THEIR VOD SERVICES PROVIDE A

GOOD, OR THE BEST LEVEL OF AUSTRALIAN CONTENT.

37

ONLY 15% DID NOT

THINK VOD SERVICES HAD ENOUGH AUSTRALIAN CONTENT.

58% OF CONSUMERS ARE SATISFIED WITH THE AMOUNT OF AUSTRALIAN

CONTENT ON THE VOD SERVICES THEY USE

38

WWW.FRONTIER-ECONOMICS.COM | 9

6. VOD services are bringing Australian content to a wider world

International VOD services are able to expand the reach of Australian stories to global audiences. VOD

services offer an unprecedented global audience and reach diverse viewers, including niche audiences

around the world who seek Australian content. Australian content producers consider not just their

domestic audiences, but in addition how their content will appeal internationally. Indeed the Hon Paul

Fletcher MP (Minister for Communications, Urban Infrastructure, Cities and the Arts) has argued that “in

the internet era, it is more important than ever to work out what your strengths are – and where you are

going to be good enough to build not just a strong market share in Australia but a strong market share

globally”.

39

By meeting international demand for Australian made content, VOD services are supporting

local producers and Australian exports and promoting the country’s artists and culture.

As of June 2021, there were at least 626 Australian titles available in the US on VOD services, 530 avaliable

in Canada, 515 available in the UK, 185 in France, 162 in Japan, 161 in Mexico, 155 in Brazil and at least 42

available in India.

40

Examples of Australian content that have been popular worldwide include:

ABC and Netflix’s co-production The Inbestigators;

Australian docuseries, Love On The Spectrum, which is produced by ABC in Australia and was

picked up for international distribution by Netflix, helping increase awareness of the show;

Australian animated TV series Bluey which was released internationally on Disney+; and

Stan’s commission, No Activity, which has been distributed widely into several overseas markets,

and the format rights to the series were sold to CBS for a US adaptiation in 2017.

In particular, Australian children’s and young adult television programmes have benefited from the

additional support and exposure VOD services can provide. Canadian-Australian director, producer and

showrunner of Dive Club, a co-production between Netflix and Network Ten, Steve Jaggi highlighted the

ability of VOD services to reach global audiences saying “For a very tiny Australian teen show on a very

humble budget to have gone out and… we actually broke through in over a dozen territories into the adult

carousel Top 10 and it was on the kids carousel in over 50 territories. So, the number of eyeballs is obviously

in the many, many millions”.

41

As well as the additional exposure, VOD services have been keen to support

the Australian features of local content. Daley Pearson, who supported Bluey’s production, said that when

he took the title to market there was feedback from other distribution outlets that they might need to

change the distinctive Australian voices of the characters, but Disney were supportive; “Disney and Disney+

were one of the ones who supported it, which was why we were really attracted to go with them… They

really supported the show's DNA”.

42

WWW.FRONTIER-ECONOMICS.COM | 10

CASE STUDY - CONTENT INVESTMENT IN AUSTRALIA:

THE INBESTIGATORS

The Inbestigators is a comedy-drama

about a kids’ detective agency that

was a co-production between ABC

and Netflix and produced by

Australian production company

Gristmill.

The creators, Robyn Butler and

Wayne Hope, say that the partnership

with Netflix allowed them to scale

and shoot two seasons

simultaneously.

The global audience for the

programme was demonstrated to the creators when they received fan art and re-enactment videos from

children in Brazil, Romania and South Korea who watched The Inbestigators on Netflix. Robyn Butler said,

“That was extraordinary to us because everything in the show is so specifically Australian”.

43

CASE STUDY - CONTENT INVESTMENT IN AUSTRALIA:

CLICKBAIT

Recently released Netflix series Clickbait was the first Netflix

original series to be produced in Victoria.

44

It was produced at

Docklands Studios Melbourne involving a majority Australian

cast and crew and it was supported by the Location Offset and

Incentive fund, and Film Victoria's Production Incentive

Attraction Fund. Australian co-creator Tony Ayres said that “We

are equally delighted to produce this US show in Melbourne. It’s

an opportunity to showcase the international level of Australian

talent both behind and in front of the camera.”

The show hit the number one most watched spot on Netflix in

more than 20 countries including Australia, the USA and the UK.

Netflix helped this made-in-Australia content become a global

success. Tony Ayres also said that “I think this proves that we

can make work in Victoria that actually competes on the world

stage, and can get the attention of the world.”

45

WWW.FRONTIER-ECONOMICS.COM | 11

CASE STUDY – CONTENT INVESTMENT IN AUSTRALIA:

WOLF LIKE ME

Stan Original series Wolf Like Me, brought

together some of Australia’s top acting,

directing and production talent to work

alongside some of the biggest names in

film and television from around the world.

Australian actress Isla Fisher starred

alongside Josh Gad. The show was

produced by Made Up Stories and written

and directed by Australian Abe Forsythe.

Filmed in NSW, Wolf Like Me was co-

commissioned by Stan and NBCUniversal’s

Peacock streaming service, which exhibited the title in the United States, while Endeavor Content is

handling international distribution of the series.

CASE STUDY - CONTENT INVESTMENT IN AUSTRALIA:

THE TEST: A NEW ERA FOR AUSTRALIA’S TEAM

Amazon Prime Video’s first Australian Original

was released in 2019. The Test: A New Era for

Australia's Team, gave an insight into the inner

sanctum of the Australian Men’s Cricket Team

through the players own voices.

The Test is produced by Cricket Australia Films

in partnership with Australian production

company Whooshka Media, involving a majority

Australian cast and crew and directed by

Australian Adrian Brown. Richard Ostroff, Head

of Broadcast & Production at Cricket Australia,

said that “The Test: A New Era for Australia’s

Team captured the inside story of the Australian

Men’s Team during a remarkable period for the

national game. Amazon Prime Video were terrific partners and collaborators on the project, which

employed over 60 Australian production specialists over an 18 month period. We are grateful for their

support and investment from Amazon Prime Video, which enabled this vital story to be told and distributed

to a vast global audience.”

The Test became an international success for Amazon Prime Video in cricket loving territories including

India, New Zealand and the UK.

WWW.FRONTIER-ECONOMICS.COM | 12

CASE STUDY – CONTENT INVESTMENT IN AUSTRALIA:

NO ACTIVITY

Just two months after launch in January 2015, Stan

commissioned its first local production, the comedy series

No Activity, produced by Jungle Entertainment which

returned on Stan for a second season and a Christmas

special.

Its success led the Australian series to be distributed into a

number of overseas markets and the format rights for the

series, created by Trent O’Donnell and Patrick Brammall,

were licensed to CBS for a US adaptation in 2017. Produced

by Will Ferrell’s Funny or Die production company, No

Activity (US) ran for three seasons on CBS All Access before

being renewed for an animated fourth season that premiered

on Paramount+ in the US. Alongside the US adaptation, the

format has been picked up for adaptation in markets

including the Middle East, Japan, Spain, Germany, and the

Netherlands.

Jungle Entertainment chief executive Jason Burrows said it

was pleasing to see the original No Activity sold to prestige

platforms including the BBC in the UK and Hulu in the US. “It

has also been very rewarding to see it become one of the

highest selling comedy formats of all time, with seven different

foreign remakes to date, including a US version starring some of the biggest stars on the planet.”

46

INVESTMENTS BRING WIDER ECONOMIC BENEFITS

7. VOD services’ investments are spurring skills, innovation and infrastructure

Content investments by global VOD services and the media companies backing them create indirect

economic benefits for the broader AV sector. Policymakers should consider these benefits when setting the

policy and regulatory environment. The benefits include skills growth and knowledge sharing, growth in

the productive capabilities and capacity of the sector from infrastructure investments, and greater

diffusion of innovations. These wider benefits can also be accrued through co-production partnerships

between VOD services and local producers or broadcasters.

The role that VOD services play in building and supporting the skills base and sector infrastructure is

particularly important at a time where there have been reports of skills shortages and constrained supply

of production infrastructure.

47

Training and skills: VOD services run a range of training and skills programmes in Australia. For

example:

WWW.FRONTIER-ECONOMICS.COM | 13

Netflix recently partnered with Screenworks and the NSW Government to provide free

training for up-and-coming creatives. Backed by a AUD500,000 investment by Netflix, the

Regional Crew Development Program will also provide placements and work experience on

real productions with the goal of creating new career pathways in the field for regional

people.

48

Stan’s recently launched partnership with the Australian Children’s Television Foundation

will include the production and development of Australian live action projects for young

and family audiences. Stan also has active development initiatives in place with State

screen agencies, Screen Queensland, Film Victoria, Screenwest, and the South Australian

Film Corporation, with similar funds currently being explored with other States.

Disney, through ILM, and in partnership with the NSW Government co-invested up to

AUD6m in the Sydney-based Jedi Academy, helping to create as many as 500 jobs over

five years.

49

Innovation: The visual effects company Industrial Light & Magic (ILM), owned by Disney, is a leader

in innovative visual effects in film. Many ILM innovations have helped films win Oscars for visual

effects. ILM continues to invest in offices and hubs around the world, including in Sydney. Recently

ILM has been innovating by producing an end-to-end virtual production solution called StageCraft

which allows for virtual reality testing and production. ILM has now built one, only the fourth in

the world, in Sydney which will be available to be used on future productions.

50

Luke Hetherington,

ILM Executive in Charge, Singapore and Sydney Studios said “The opportunity to set StageCraft up

right on the doorstep of ILM’s Sydney studio was incredibly exciting. StageCraft is a great example of

ILM innovating to help filmmakers tell their stories in new ways, and building that knowledge and

those skills right here in Sydney is amazing.”

51

Sector infrastructure: As well as incentivizing investment through increased demand for

production space, VOD services invest in infrastructure too. For example:

Disney owns Fox Studios which is the largest production facility in the Southern

Hemisphere. It provides a full working ecosystem including pre-production, physical

production and post production. The studio has been utilised by a significant amount of

Australian productions including scripted drama, light entertainment, documentaries and

feature films. The lot includes an industry ecosystem of third party Australian businesses

employing roughly 2,000 people.

Netflix’s Post-Production Partner programme is profiting local firms such as Cutting Edge,

Silver Trak Digital and Soundfirm. The collaborative scheme aims to improve the quality of

post-production elements such as dubbing, audio description, scripting and quality

control.

52

Wider benefits from co-productions: VOD services have partnered with local players on co-

productions of projects such as Dive Club which was recently co-commissioned by Netflix and

Network 10 and The Unlisted (ABC and Netflix). Co-producing content with local partners can

support positive outcomes for producers and consumers in a number ways. First, co-productions

can more efficiently share risk and thereby increase the scope for higher quality and bigger budget

WWW.FRONTIER-ECONOMICS.COM | 14

productions. Second, the close commercial relationship between VOD services and local producers

supports the diffusion of innovation and skills around Australia’s AV sector. Third, co-productions

enable Australian content to reach wide domestic audiences on free-to-air services, while also

finding global audiences on subscription VOD services.

CASE STUDY – CONTENT INVESTMENT IN AUSTRALIA:

MR.INBETWEEN

Mr. Inbetween is a critically acclaimed

Australian series that, for seasons two and

three, was funded by Disney-owned FX and

licensed to Foxtel for viewing in Australia.

Globally, the series is available on Disney-

owned Hulu in the US and Disney+ in many

other countries around the world. The

production’s entire cast, crew and writers

were Australian with the production shot in

New South Wales.

53

This production, similar to other case studies

shown here, was a collaborative production

and highlights the complex investment relationships that exist between VOD services, production studios

and broadcasters.

8. VOD services’ investments are producing broader benefits for Australia

VOD investments bear fruit beyond the AV sector. The creative industries generate disproportionately wide

economic impacts. Specifically, the industry can connect people, cut across cultural and political divides,

and act as a source of identity and expression. Content and stories are a powerful tool to aid national

integration, deliver social messages and project Australia’s culture and influence on the global stage.

Through diversified local investment, training partnerships and key content decisions, VOD services can

help achieve broader social goals and positively impact the community.

The Bunya Indigenous Talent Hub is a talent incubator and global networking program that was

run in 2020 in partnership between Netflix and Screen Australia. It was open to Indigenous writers,

showrunners, directors and producers who developed and pitched a film or television project to

content executives from Netflix and other industry practitioners.

54

Netflix has also partnered with the Australian Film Television and Radio School (AFTRS) to set up

the Netflix Indigenous Scholarship Fund.

55

Netflix will provide AUD515,000 to the Fund for a

range of initiatives to elevate Indigenous creatives and voices in the Australian screen and

broadcast industries and support Australia’s First Nations communities and storytellers. The fund

aims to support individual careers and improve the inclusion and cultural capacity of the industry.

Netflix and Australian charity Support Act launched a AUD1m COVID-19 film and TV emergency

relief fund. The aim was to help and support casual workers who lost their jobs when productions

were shut down or postponed.

56

Mr Inbetween is available on Foxtel on demand © FX Networks LLC

WWW.FRONTIER-ECONOMICS.COM | 15

Investing in content can attract tourists who want to see where their favourite show was shot. VOD

services, with their ability to bring Australian content to a global audience, are exceptionally well placed to

stimulate tourism and produce wider reputational benefits for Australia, long after a title’s initial release.

By showcasing Australia, VOD raises the country’s international profile and reputation. Content-induced

tourism is on the rise. A TripAdvisor survey suggested that 20% of global travellers have visited a

destination because they saw it in a TV show or movie.

57

On-screen content attracts around 230,000 international visitors to Australia each year, driving an

estimated AUD725m in tourism expenditure.

58

Research has shown that content helps to create connections between viewers and locations

through scenes on screen. The connections can lead to a growing cultural affinity with the country

leading to more interest in that country, including products from that country and potential

tourism.

59

HELP INVESTMENT, DON’T HINDER IT

9. Pro-investment policies can keep Australia’s AV sector growing

Australia benefits when policies attract investment in content and in the wider AV ecosystem. This high-

value-added activity makes a disproportionately large contribution to GDP, it provides skilled, well-paid

employment, and supports a country’s exports.

However, production of top-quality content is costly. It requires sector-specific infrastructure, state-of-the-

art technology, complex production processes and large crews of highly trained specialists from many

different trades. At the same time, content creation - like any art form - is a risky investment.

Policies such as tax rebates or grants that mitigate the risk and high fixed costs of content creation have

been found to significantly increase content investments.

60

Australia has been successful in attracting

international investment through a number of federal and provincial schemes such as the Location

Incentive grant, the Location Offset tax rebate and the Producer Offset rebate.

Since being launched in July 2019, 23 productions have been drawn to Australia through the

Location Incentive program. These productions are expected to generate around AUD1.7bn of

expenditure and, importantly, are creating a sustained pipeline of work for Australians, generating

more than 15,800 jobs for local cast and crew, and using the services of more than 15,200

Australian businesses.

61

Dr. George Miller, the director of the upcoming film Furiosa, said that federal and state incentives

were pivotal to Furiosa being produced in Australia. The WarnerBros film will be shot in New South

Wales and state premier Gladys Berejiklian said “This is great news for New South Wales – Furiosa is

expected to support more than 850 local jobs and bring around AUD350m into the New South

Wales economy”.

62

The Producer and PDV offsets supported 213 Australian children’s drama, documentary and

entertainment productions in 2020/21.

63

The addition of AUD400m to the Incentive grant and the increase in the Producer Offset from 20% to 30%

for eligible formats in the last year have continued to send the right signals to global investors and kept

WWW.FRONTIER-ECONOMICS.COM | 16

the incentives to invest high.

64

In addition, the AUD50m Temporary Interruption Fund supported the

industry through the pandemic ensuring Australian content production was not lost.

Policymakers can also ensure a strong supply of skilled, high-value workers by supporting training

programmes that will benefit both global and local players active in Australia. The government’s improved

incentives, along with the growth in investment driven by VOD services, has created strong demand for

local and global content production in Australia which is now generating demand for more skilled workers

and production infrastructure. A survey conducted by Screen Producers Australia confirmed this showing

that over 80% of producers surveyed faced increased challenges staffing their projects and over 95%

report increased crew costs.

65

Global content producers invest in Australia to access a highly skilled

workforce as well as state-of-the-art studio infrastructure and a rich ecosystem of suppliers. This

attractiveness needs to be maintained and built on to ensure high quality, high impact investments

continue to be made in Australia.

INCENTIVES AND HIGH QUALITY INFRASTRUCTURE SUPPORT INVESTMENT IN THE AUSTRALIAN SECTOR

Disney+ original series Nautilus highlights how the

combination of Australian incentives and high quality

infrastructure and talent attracts investment.

Nautilus is to be produced in Australia with AUD23.3m

of assistance from the Location Incentive grant program.

66

The series will be filmed in Queensland at Village

Roadshow Studios and will also be supported by the

Screen Queensland’s Production Attraction Strategy,

thereby showing the impact incentive policies can have.

Kate Marks, CEO, Ausfilm said that “it is promising to see

that Australia has been chosen yet again to film another major international project, which is undoubtedly a

result of the Morrison Government’s Location Incentive program combined with state government support

from the Queensland Premier and the incredible reputation of Australia’s talented cast, crew and facilities.”

67

As a return on these incentives the production is expected to create more than AUD172m of local

economic activity through jobs and local spending.

Government policies, including regional and federal grants and rebates to incentivise and support media

investment, can have large multiplier effects on the wider economy and on the government’s fiscal

position. These can outweigh the costs of polices to attract investment. For example, by 2016-17 the

production incentives had added AUD3.86 in GVA for each dollar in offset awarded. In addition, the cost

of the offsets had been recovered as the additional economic activity from the offsets paid an average of

AUD1.05 in taxes back to the government for each dollar in incentive granted.

68

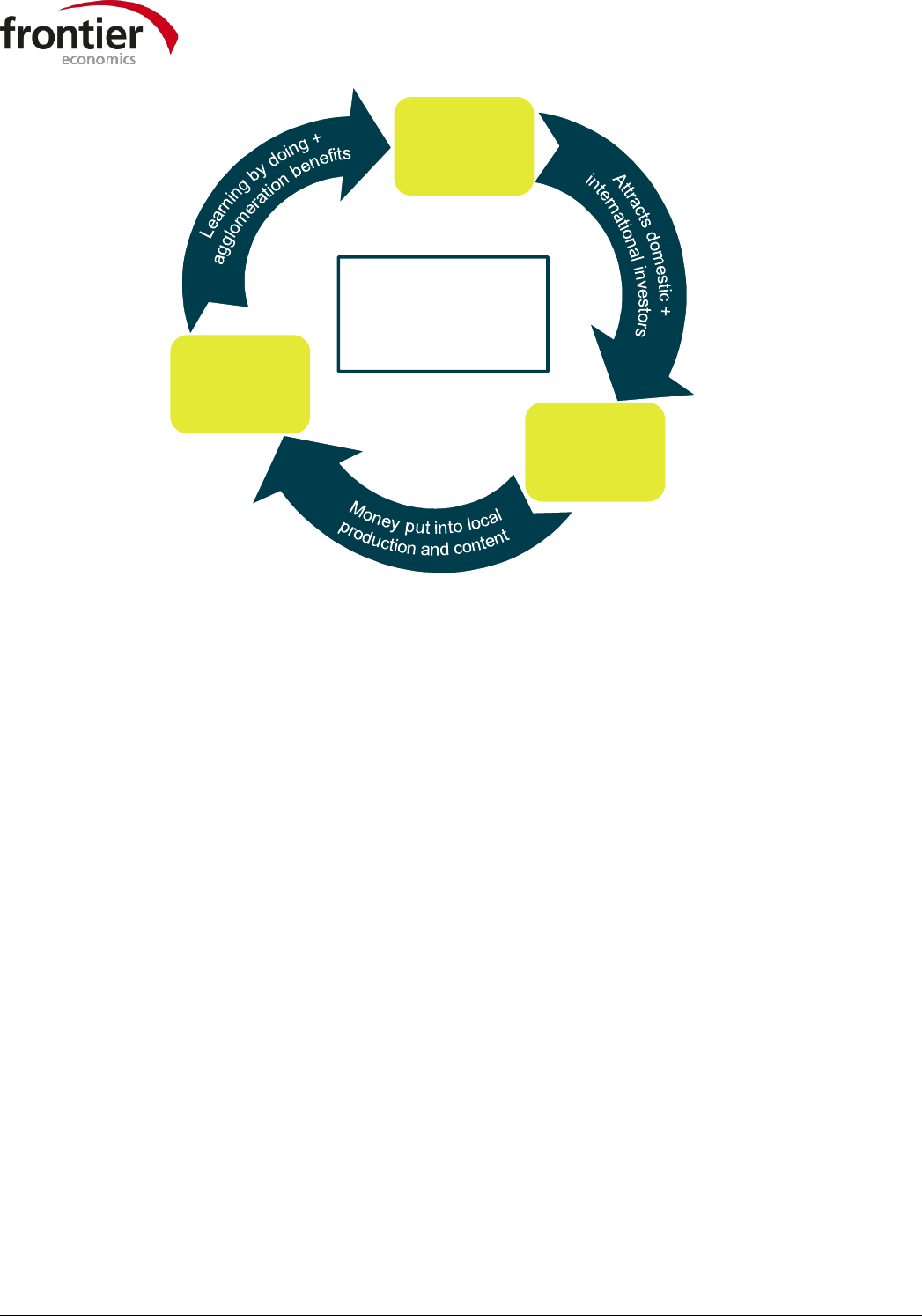

A policy framework that encourages investment by VOD services in the AV sector in Australia could

underpin a virtuous circle of investment.

69

Catalysing investment in infrastructure and skills enhances the

industry’s capacity and capabilities. This, in turn, makes the country an increasingly attractive location for

new investment.

WWW.FRONTIER-ECONOMICS.COM | 17

These policies can nurture the growth of self-sustaining “creative hubs of local production” with global

producers and major studios incentivised to locate and concentrate activities in Australia, to the benefit

the local economy.

70

Investment by major global studios and VOD services in Australia has supported the development of a

thriving local creative economy. The same global studios have established production hubs, investing in

infrastructure to support production, post-production and VFX and their investments have encouraged

investments by other players in the industry too.

Disney’s Fox Studios in Sydney has attracted some of the largest and most iconic international

feature films ever produced since opening in 1998. As well as increased production, the site has

seen increased investment with studio expansions and has now attracted over 50 support

businesses to be based on the studio complex providing services such as lighting, camera and

textiles hire, casting and editing. The support businesses, plus the ILM academy and training

facilitiy nearby have helped it become a production hub in Australia.

71

Increased content investments across Australia have led to government and state infrastructure

investments to create hubs. For example, a AUD150m investment to create a hub of studios in

Penrith,

72

Western Sydney and the expansion of the Docklands Studio Melbourne hub with a water

tank super stage.

73

Investments have been made to establish new film studios at Coffs Harbour and to build a Bryon

Studios production facility near Ballina in New South Wales in response to rising demand.

74

Also a

AUD100m investment has been proposed by local government to build a studio and sound stage

in Fremantle, Western Australia.

75

Infrastructure

and skills

Investment

Local

production

Virtuous cycle

of investment

and skills

WWW.FRONTIER-ECONOMICS.COM | 18

Policies that discourage or constrain foreign investment or market entry, or reduce investment flexibility

can disrupt this virtuous cycle. Instead of the local AV sector enjoying rising investment, cutting-edge

infrastructure and ever-higher skill levels, more “protectionist” policies may hamper innovation and

growth opportunities in the long run.

76

10. Our research finds that protectionist policies can hurt the economic potential of local AV industries

“Protectionist” policies intended to shield local companies from international competition could result in

local industries that are inward-looking, less innovative and less able to produce high-quality content that

is in demand internationally. Many countries have cultural policies aimed at promoting local content, but

some come at a cost and prove ineffective at achieving the goals they pursue. Our analysis, which

examined the relationship between protectionist policies and AV trade (i.e. licensing content

internationally), found that higher levels of protection (for example the introduction of content quotas)

lead to reductions in AV exports.

77

This implies that countries with more-protectionist policies are less

able to monetise their content in international markets, or show off and promote their culture to audiences

around the world.

11. Put up barriers and you may put off investors in content

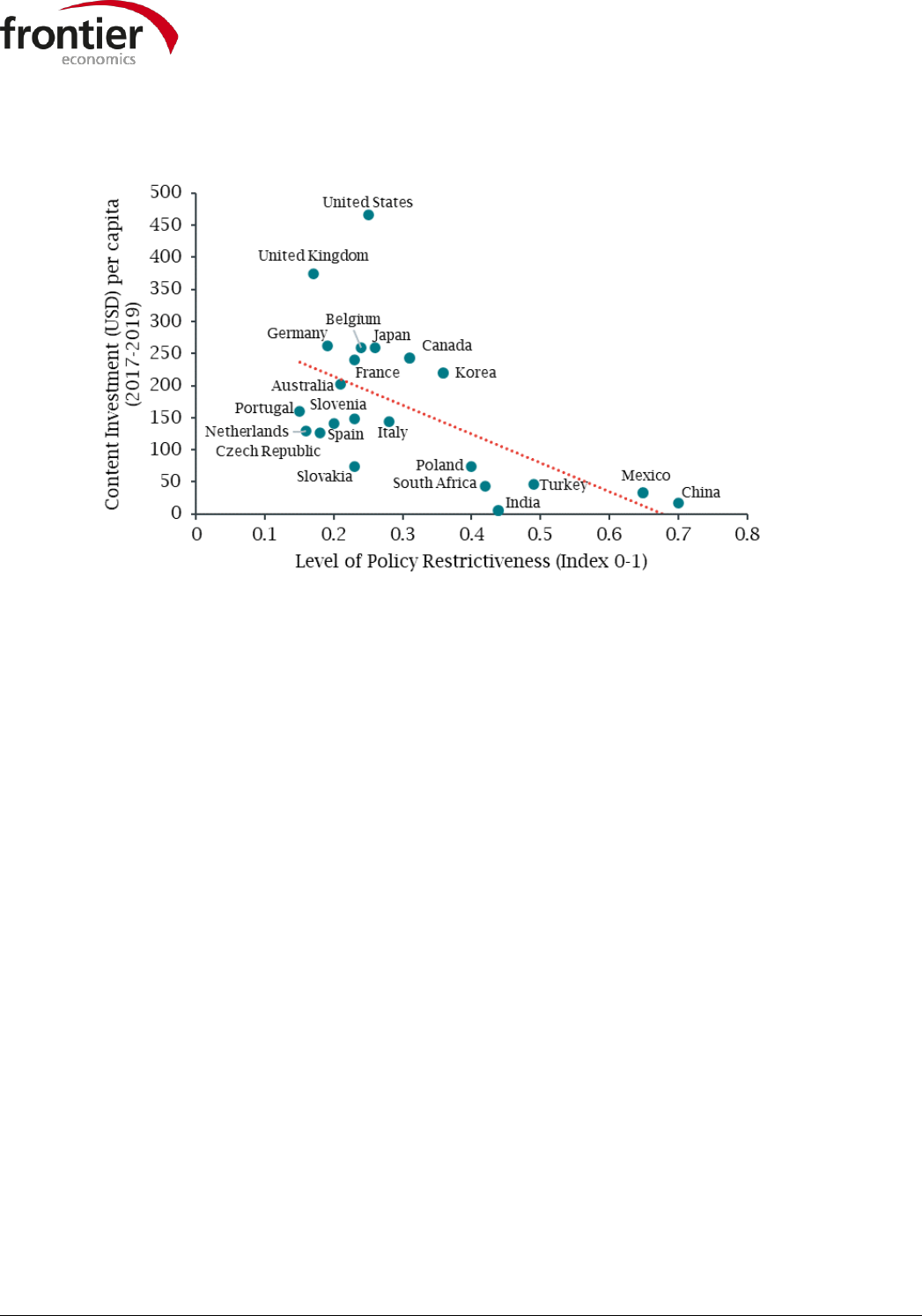

Countries that have greater policy restrictions tend to have lower levels of investment in content. While

there are many other factors at play,

78

Figure 5 below is consistent with the hypothesis that protectionist

policies discourage content investment (at least for the countries selected). The result of lower content

investment is inevitably lower employment and skills development in the sector.

FOR EXAMPLE, INCREASING AV

POLICY RESTRICTIONS, EQUIVALENT

TO INTRODUCING QUOTAS FOR

BROADCAST TIME…

…REDUCED BROADCASTING

EXPORTS IN THAT COUNTRY BY

4.3%.

…LEADS TO…

WWW.FRONTIER-ECONOMICS.COM | 19

FIGURE 5 RESTRICTIVE AV POLICY CORRELATES TO LOWER INVESTMENT (SELECTED OECD

COUNTRIES AND CHINA)

Source: Frontier analysis of Ampere and OECD data

Note: All values of content investment are nominal. For each country, content investment data includes investment by commercial and public

broadcasters and also by selected VOD services, where spend can be disaggregated by country. Excludes any investment in sports rights. Countries

were selected based on data availability and include OECD countries and China. The level of policy restrictiveness is the OECD’s broadcasting

sector specific Services Trade Restrictiveness Index (STRI) which captures the level and range of non-tariff barriers in services trade within the

broadcasting sector. The STRI is a widely used measure of policy restrictions on services used by academics and policy makers. The STRI is an

index between zero and one attributed to each country, where zero would imply no policy restrictions, and one the highest possible policy

restrictions.

12. Restrictions reduce incentives

Australia is home to a growing AV industry, though VOD services in Australia are relatively recent

additions to the AV sector, with domestic and international VOD services launching later than in some

other countries and new services launching each year. Policymakers can encourage this growth to continue

in a way that continues to benefit the local creative sector and the broader economy. While protectionist

restrictions (such as expenditure obligations, content quotas, conditional visas for foreign actors and

broadcast quotas) have a number of legitimate policy objectives (such as supporting the creation or

consumption of local cultural content, or helping the domestic AV sector) they can also have adverse

impacts.

Investment obligations are designed to ensure sufficient levels of investment in local content, but

implementing them can have unintended consequences such as;

Reduction in flexibility of investment decisions may lead to investment in titles to fit a

quota rather than to meet audience demand. Lower flexibility may also reduce the ability

to experiment with content missing out on future potential production and content

innovations.

Increased pressure on production facilities could potentially lead to cost inflation which

may reduce the level of future investment.

WWW.FRONTIER-ECONOMICS.COM | 20

Investment quotas combined with restrictive local content definitions might lead to more

homogenous content and services and less scope for innovation and less ability to scope

services to specific consumer needs. Such homogeneity might impact competition and the

ability of local or regional services to differentiate.

Restrictions can drive up costs for domestic and foreign companies, reducing competition and

raising prices for consumers.

79

This cost may be particularly relevant in Australia where production

facilities and crew are already in high demand, so additional demand may just inflate prices in the

near to medium term.

Policy restrictions that erect barriers to inward investment deter the influx of international capital,

talent and skills, and can restrict the adoption of new techniques and innovations that inbound

investment brings.

Onerous definitions of local content for the purpose of defining local content obligations, can

discourage investment in local content and the local industry.

80

In the Media content consumption

survey 2020, ‘Made in Australia’ was the criteria considered by most Australian adults (74%) as

what makes media content ‘Australian’. This could suggest that additional criteria beyond this may

not only be restrictive for producers but also unimportant to consumers.

81

Broadcast-time quotas are designed to nudge consumers towards local content but implementing

them for VOD services can be problematic.

Quotas applied to VOD services may not be effective in changing tastes, as consumers

choose their content on demand.

82

Quotas can distort incentives, as services are motivated to focus on the quantity of local

content rather than its quality, which could have less of an economic impact.

83

84

VOD services may reduce the size of their overall libraries in proportion to the volume of

local content that they are able to license, leading to less choice for consumers and less

investment in wider production by VOD services, without increasing actual volume of local

content.

Quotas can create barriers to entry as they may disproportionately affect smaller VOD

entrants rather than established VOD services with large domestic customer bases or

content libraries.

Where the goal is to increase domestic capacity and capabilities, joint productions with foreign companies

may be more effective than restricting entry or applying additional requirements on international services

in domestic markets.

Restrictive policies may also have the unintended effect of increasing levels of piracy. Piracy drains a

country’s AV economy by reducing the returns on investment and blunting the incentives of creatives to

innovate and produce new content. It also reduces the government’s tax take as legitimate business

revenue streams are hit. 24% of VOD users in Australia have said that they would watch or download VOD

content from unauthorised services if it was not otherwise available, to the detriment of both the country’s

economy and its culture.

85

In summary, some protectionist policies can increase costs, restrict investment and ultimately limit the

content available to local consumers, with potentially further negative consequences for the creative

industries in Australia.

WWW.FRONTIER-ECONOMICS.COM | 21

VOD SERVICES CAN HELP

AUSTRALIA’S AV INDUSTRY

CONTINUE TO THRIVE

Australia has a vibrant film, television and video on-demand

industry, and VOD services in Australia make a significant and

growing economic contribution within that sector. Consumers are

increasingly subscribing to VOD services, which invest in

Australian content that audiences want to watch. VOD services

also act as an international shop window for the country’s culture,

while bringing Australian stories to global audiences.

By carefully calibrating policy and regulations to incentivise

investment while still allowing flexibility in investment decisions,

Australia will enjoy wider benefits such as increased employment,

higher economic output, increased exports, a growing skills base,

and expanding sector infrastructure. This, in turn, creates

conditions to attract new investment. Policymakers should

therefore be mindful of potential unintended consequences of

some types of protectionist policies. These can reduce incentives

to invest, lower sector outputs and exports, raise costs and even

increase piracy. By working with VOD services, producers and

production companies, policymakers can create the right

conditions to support investment and further expand the

flourishing film, television and on-demand industry in Australia,

thereby ensuring the creative sector in Australia will continue to

thrive.

1

VOD subscribers counts the number of paid subscriptions there are to VOD services in Australia. These are

often used by more than one person, usually within the same household.

2

Results are from an online consumer survey of 1,107 Australian internet users (“Kantar Survey”). The survey,

designed by Frontier Economics, was conducted by Kantar between 29

th

September and 20

th

October 2021. See

technical annex for further detail. Question: How often do you watch online subscription services which offer

professionally-produced full length movies, shows or series for a regular fee, such as Netflix, Stan, Disney+ or

Binge? Please exclude services that show videos uploaded by individual users such as YouTube. Base: All

respondents (1,107)

3

Kantar Survey, Question: When you watched your online subscription service(s) last week, how many hours did

you spend watching Australian content? Base: Respondents who watched subscription VOD at least once a week

(802)

4

The average 2020 USD-AUD exchange rate has been used to convert USD figures into AUD. OECD Exchange

Rates.

5

Ampere, Subscription VOD revenue 2020, extracted September 2021

6

Ampere, Subscription VOD revenue forecasts to 2025, extracted September 2021

7

Deadline, With Ambitious Paramount+ Launch, ViacomCBS Targets 65 Million-75 Million Streaming Subs By

2024, February 2021

8

Variety, Inside HBO Max, the $4 Billion Bet to Stand Out in the Streaming Wars, May 2020

9

Fortune, Netflix will spend over $17 billion on content in 2020: Analyst, January 2020

10

ACMA, Spending by subscription video on demand providers 2020–21

AUTHORS

CLIVE KENNY

Frontier Economics

DANIEL LEWIS

Frontier Economics

WANT TO KNOW MORE?

WWW.FRONTIER-ECONOMICS.COM

HELLO@FRONTIER-ECONOMICS.COM

+44 (0) 207 031 7000

WWW.FRONTIER-ECONOMICS.COM | 22

11

The definition used for an Australian program is consistent with Section 10 of the Broadcasting Services (Australian Content and Children’s Television) Standards 2020

12

As stated in the ACMA report, Spending by subscription video on demand providers 2020–21, ‘Australian-related’ programs are classified as shows that meet at least one criteria

of an ‘Australian program’. For example, at least one aspect of creative control is performed by an Australian.

13

ACMA, Spending by subscription video on demand providers 2019–20

14

The Sydney Morning Herald, Room for one more? Paramount+ to hit Australian screens this winter, May 2021

15

C21Media, ViacomCBS orders trio of formats from Endemol Shine Australia for 10, Paramount+, October 2021

16

Stan submission to Media Reform Green Paper, May 2021

17

Screen hub, Amazon Prime Video greenlights seven new Australian productions, May 2021

18

The Sydney Morning Herald, 'Quality is fantastic': Netflix reveals $110m spend on Australian children's shows, August 2020

19

Netflix submission to Media Reform Green Paper, May 2021

20

Screen Australia, Drama Report - Production of feature films, TV and online drama in Australia in 2020/21, p.25 - 2021

21

Olsberg•SPI, Global Screen Production – The Impact of Film and Television Production on Economic Recovery from COVID-19, June 2020

22

Australian Government, Media Reform Green Paper – Modernising television regulation in Australia, November 2020

23

ACMA, Spending by subscription video on demand providers 2020–21

24

Screen Australia, Drama Report - Production of feature films, TV and online drama in Australia in 2020/21, 2021

25

Screen Australia, Drama Report - Production of feature films, TV and online drama in Australia in 2020/21, p.30 - 2021

26

ViacomCBS submission to Media Reform Green Paper, May 2021

27

ausfilm, DORA EXPLORES THE GOLD COAST ,October 2019

28

Streaming industry submission (Disney+, Netflix, Stan, Prime Video) in response to the Options Paper Supporting Australian Stories on our screens, July 2020

29

Screen NSW, Marvel Studios to film “Thor: Love and Thunder” in Australia

30

The Sydney Morning Herald, Has Shantaram curse finally lifted? Production to restart, 15 months on, April 2021

31

Paul Fletcher MP, Netflix partners with Victorian creators to bring ‘Clickbait’ to Melbourne, August 2019

32

Paul Fletcher MP, Hit television series The Wilds set to film in Queensland Starring Rachel Griffiths, Mia Healey, and Shannon Berry, February 2021

33

Redland City Council News, Minjerribah sets the scene for The Wilds filming, September 2021

34

Kantar Survey

35

Kantar Survey, Question: When you watched your online subscription service(s) last week, how many hours did you spend watching Australian content? Base: Respondents who

watched subscription VOD at least once a week (802). This is consistent with other research done across APAC countries (AlphaBeta, Asia-On-Demand, 2018).

36

Kantar Survey, Question: Considering all TV and video services you use, how important is it that your TV and video services provide the following types of content on a scale of 1-5?

Scale; 1 = Not important to me at all, 2 = somewhat unimportant, 3 = neutral, 4 = quite important to me, 5 = Very important to me. The content types were content that includes

people like me, content that represents where I live, content which represents an authentic portrayal of the region where I live, content that is made in Australia, content that is

relevant to my life, content that is made by people from Australia. The result shown here is the proportion of respondents that felt it was quite or very important that their TV

and video services provide at least one of the types of content related to Australian content (content that represents where I live, content which represents an authentic portrayal

of the region where I live, content that is made in Australia, content that is made by people from Australia). Results for the other two content types, representative content, were

not used, but results were similar. Base: All respondents (1,107)

37

Kantar Survey, Question: Considering the online subscription service(s) you use, how well do they provide content that is made specifically for Australians for example, telling

stories about people in Australia, or with actors or presenters from Australia? ? Scale: 1 = Does not provide any content that is made specifically for Australians at all, 2 = Does not

provide enough content that is made specifically Australians, 3 = Provides some content that is made specifically for Australians, 4 = Provides a good level of content that is

made specifically for Australians and 5 = Provides the best possible level of content that is made specifically for Australians. Base: All respondents that use the services at least

once every 3 months (877)

38

Kantar Survey, Question: Considering the online subscription service(s) you use such as Netflix, Stan, Disney+ or Binge, , on a scale of 1-5, how satisfied are you with the with the

amount of content on these services that is made specifically for Australians?? Scale; 1 = Very unsatisfied, 2 = somewhat unsatisfied, 3 = Neutral, 4 = somewhat satisfied, 5 = Very

satisfied. Base: Respondents who watch online subscription services at least once every three months (877)

39

Paul Fletcher, Governing in the Age of the Internet, ACMA, Monash University Publishing 2021

40

ACMA, Spending by subscription video on demand providers 2020–21

41

Screen Australia, SPOTLIGHT ON KIDS’ TV, November 2021

42

Screen Australia, SPOTLIGHT ON KIDS’ TV, November 2021

43

The Sydney Morning Herald, 'Quality is fantastic': Netflix reveals $110m spend on Australian children's shows, August 2020

44

Netflix, Netflix Scripted Thriller Series "Clickbait" Hooks Its First Cast Members, December 2019

45

The Sydney Morning Herald, Australian show Clickbait tops Netflix charts around the world, October 2021

46

Stan.

47

Screen Producers Australia, Local Productions Facing Skills Shortage, April 2021

48

Netflix, New Partnership With Screenworks And Netflix Provides Career Pathways In Booming Screen Industry, August 2021

49

ausfilm, ILM’s Jedi Academy Invests In Inclusion, May 2021

50

ausfilm, Gathering The Forces: Ilm’s Sydney Studio Brings In Global Expertise To Hire And Train Local Talent For Stagecraft Expansion, January 2021

51

ausfilm, Gathering The Forces: Ilm’s Sydney Studio Brings In Global Expertise To Hire And Train Local Talent For StageCraft Expansion, January 2021

52

Netflix Post Partner Program - https://np3.netflixstudios.com/

53

Screen Australia, FX AUSTRALIA COMMISSIONS FIRST LOCAL PRODUCTION, June 2017

54

Screen Australia, Participants Announced For The Bunya Talent Indigenous Hub In LA, January 2020

55

Netflix, AFTRS And Netflix Announce $515,000 Netflix Indigenous Scholarship Fund, June 2021

56

If.com.au, Netflix donates $1 million to help displaced screen industry workers, June 2020

57

TripAdvisor, 6 key travel trends for 2016, December 2015

WWW.FRONTIER-ECONOMICS.COM | 23

58

Screen Australia, Screen Currency Valuing Our Screen Industry, 2016

59

World Tourism Organization and Netflix (2021), Cultural Affinity and Screen Tourism – The Case of Internet Entertainment Services, UNWTO, Madrid

60

BFI (2018) How screen sector tax reliefs power economic growth across the UK. Study found that 91% of production would not have occurred absent the tax relief.

61

Paul Fletcher MP, Media Release - Record year of funding: $530 million to support screen sector, August 2021

62

Variety, George Miller’s ‘Furiosa’ Set to Be Australia’s Biggest Film Shoot Ever After Receiving Financial Incentives, April 2021

63

Paul Fletcher MP, Media Release - Record year of funding: $530 million to support screen sector, August 2021

64

The Australian Government added AU$400 million to the Location Incentive grant in July 2020. The grant is available from 1st July 2019 to 30 June 2027. This is in addition to

the AU$140 million announced in May 2018. The grant total is now AU$540 million. In addition, the Australian Government announced changes and updates to the Producer

Offset that will come into effect on 1st July 2021. The changes mentioned in this report are that the rate of the Producer Offset will be raised from 20% to 30% for eligible formats,

such as drama and documentary content for television and streaming platforms. ausfilm – Incentives.

65

Screen Producers Australia, Local Productions Facing Skills Shortage, April 2021

66

Paul Fletcher MP, Media Release - Disney+ Original Series to inject $172 million into Australian economy, August 2021

67

ausfilm, Australia Welcomes Disney+ Original Series Nautilus, August 2021

68

In 2018 Olsberg•SPI analysed the return on investment for the government of the Producer, Location and PDV Offsets available at the time in terms of gross value added and tax

receipts. They calculated that up to financial year 2016-17 the production incentives had added AUD3.86 in GVA for each dollar in offset awarded. In addition, the cost of the

offsets had been recovered as the additional economic activity from the offsets paid an average of AUD1.05 in taxes back to the government for each dollar in incentive granted.

.Olsberg•SPI, Impact of Film and TV Incentives in Australia - A Report for the Australian Screen Association by Olsberg•SPI, March 2018

69

Messerlin. (2019). Building Consistent Policies on Subsidies in the Film Industry. Kritika Kultura, 32, 375-396.

70

Karlsson, C., & Rouchy, P. (2015). Media clusters and metropolitan knowledge economy. Handbook on the Economics of the Media.

71

Fox Studios Australia, Partner Businesses

72

NSW Department of Planning, Industry and Environment, Penrith set to become Australian film and TV capital, August 2021

73

Film Victoria Australia, Melbourne’s New Super Stage And Water Tank Is A Game Changer, 2020

74

Variety, Byron Studios Development to Expand Stage Capacity in Australia, September 2021

75

If.com.au, WA Government promises $100 million studio and $20 million production attraction fund, February 2021

76

Paul Fletcher, Governing in the Internet Age, 2021, p.45 - in the internet era, it is more important than ever to work out what your strengths are – and where you are going to be

good enough to build not just a strong market share in Australia but a strong market share globally

77

This analysis examines the relationship between protectionist policies and audiovisual trade. An econometric model was used that simultaneously estimates how different

factors impact the level of audiovisual trade between countries. This was done in order to correctly isolate the impact of trade restrictiveness on audiovisual exports (as measured

by the OECD’s Services Trade Restrictiveness Index). See technical annex for further detail.

78

Factors that affect the level of investment in a country include the existing capital stock in the sector, the level of income of a country and the level of public investment.

79

OECD. (2015). Emerging Policy Issues: Localisation Barriers to Trade. Paris: OECD Publishing

80

Lee, B., & Bae, H.-S. (2004). The Effect of Screen Quotas on the Self-Sufficiency Ratio in Recent Domestic Film Markets. Journal of Media Economics, 163–176

81

Department of Infrastructure, Transport, Regional Development and Communications, Media content consumption survey, November 2020

82

Picard, R., Davis, C., Papandrea, F., & Park, S. (2016). Platform proliferation and its implications for domestic content policies. Telematics and Informatics, 683-692

83

Anderson, C., Leigh, G., Swimmer, & Wing, S. (1997). An empirical analysis of viewer demand for US programming and the effect of Canadian broadcasting regulations. The

Journal of the Association for Public Policy Analysis and Management, 525-540

84

Crampes, C., & Hollander, A. (2008). The regulation of audiovisual content: quotas and conflicting objectives. Journal of Regulatory Economics 34.3, 195-219

85

Kantar Survey, Question; If the online subscription service that you use became unavailable to you, would you try and watch or download movies, shows and series from that

service from another source, even if it was an unauthorized service, or app?, Scale: 1 = Definitely would not, 2 = Probably would not, 3 = Maybe, 4 = Probably would, 5 = Definitely

would. Base: All respondents that use the service at least once every 3 months (877).